placer county sales tax 2020

And the sale begins at 10 am. The December 2020 total local.

2851 Plan Ladera Ranch Sun Valley Nevada D R Horton Ladera Ranch Ladera Sun Valley

Has impacted many state nexus laws and sales tax collection requirements.

. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. The total sales tax rate in any given location can be broken down into state county city and special district rates. Automating sales tax compliance can help your business keep compliant with changing.

The December 2020 total local sales tax rate was also 7250. Interactive Tax Map Unlimited Use. County of Placer TO.

It was defeated. Registration begins at 9 am. December 20 2021 properties postponed from the October 5th 2021 Tax Land Sale.

The current total local sales tax rate in Placer County CA is 7250. Rates Effective 07012020 through 09302020. Exceptions include services most groceries and medicine.

This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price exceeds 100. The main increment is the state-imposed basic sales tax rate. Leaders said they are about nine years.

Todd Leopold County Executive Officer SUBJECT. To review the rules in California visit our state-by-state guide. Placer County CA Sales Tax Rate.

The County Tax Collector collects taxes for more than 70 different taxing agencies within the county. Retailers are taxed for the opportunity to sell tangible items in California. April 21 2020 FROM.

California City and County Sales and Use Tax Rates. This table shows the total sales tax rates for all cities and towns in Placer. The current total local sales tax rate in Auburn CA is 7250.

The December 2020 total local sales tax rate was also 7750. 1788 rows California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. The current total local sales tax rate in Roseville CA is 7750.

Honorable Board of Supervisors DATE. No personal checks will be accepted. City Rate County.

There is no applicable city tax. All cashiers checks must be made payable to the Placer County Tax Collector. The office collects over 230 different taxes including special assessments and direct charges.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. The highest number of sales tax measures 129 were on the ballot in 2020 while no sales taxes were proposed in 2010. Community Resource Development Center.

Placer County could vote on half-cent sales tax for Highway 65 improvements. These buyers bid for an interest rate on the taxes owed and the right to collect. The 725 sales tax rate in lincoln consists of 6 california state sales tax 025 placer county sales tax and 1 special tax.

List of Parcels Subject to Tax Sale In December 2021. The Placer County sales tax rate is. The minimum combined 2021 sales tax rate for roseville california is.

The Placer County California sales tax is 725 the same as the California state sales tax. For tax rates in other cities see California sales taxes by city and county. A yes vote supported authorizing an additional sales tax of 1 for 7 years generating an estimated 256 million per year for general services including law enforcement fire services and code enforcement.

For the 20202021 tax year they are 1079687582. Roseville CA Sales Tax Rate. The December 2020 total local sales tax rate was also 7250.

While large parts of it have seen recent updates the work is far from done. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Placer County CA at tax lien auctions or online distressed asset sales. The 725 sales tax rate in Lincoln consists of 6 California state sales tax 025 Placer County sales tax and 1 Special tax.

The base sales tax rate of 725 consists of several components. The sales tax is assessed as a percentage of the price. California has a 6 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes.

Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer County totaling -025. Retailers typically pass this tax along to buyers. You can print a 725 sales tax table here.

Placer County CA currently has 345 tax liens available as of February 16. All sales require full payment which includes the transfer tax and recording fee. Auburn California Measure S Sales Tax November 2020 Auburn Measure S was on the ballot as a referral in Auburn on November 3 2020.

Placer County Recognized Obligation Payment Schedule ROPS 20-21 - Report of Cash Balances July 1 2017 through June 30 2018 Report Amounts in Whole Dollars Pursuant to Health and Safety Code section 34177 l Redevelopment Property Tax Trust Fund RPTTF may be listed as a source of payment on the ROPS but only to the extent no other. 3091 County Center Dr Auburn CA. South Placer County District Transportation Sales Tax Expenditure Plan ACTION REQUESTED Adopt a resolution approving the expenditure plan for a proposed ½ cent 30-year transportation.

Planning Commission Hearing Room. ICalculator US Excellent Free Online Calculators for Personal and Business use. Ad Lookup Sales Tax Rates For Free.

The 2018 United States Supreme Court decision in South Dakota v. The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County. The December 2020 total local sales tax rate was also 7250.

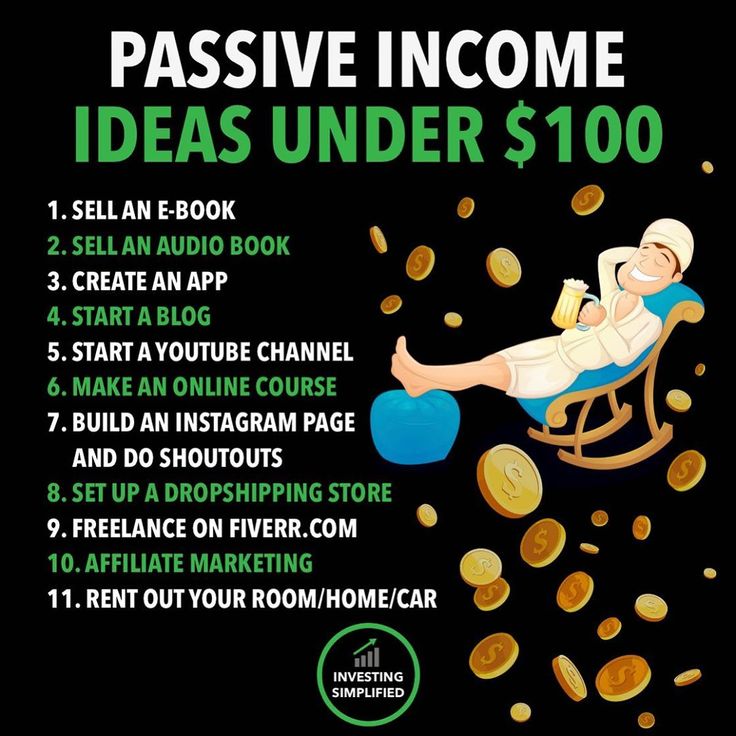

Who Loves Passive Income Passiveincome I Help Local Businesses And E Commerce To Generate Reve Start Online Business Personal Finance Budget Business Money

15 Sophisticated And Classy Mediterranean House Designs Home Design Lover Mediterranean Exterior Mediterranean Exterior Design Mediterranean House Designs